Qualified Business Deduction 2024 Requirements – Ready or not, the 2024 tax filing first-year depreciation deduction. Bonus depreciation, implemented by the Tax Cuts and Jobs Act (TCJA) in 2017, allows business owners to write off a large . There are tons of popular tax breaks out there. Whether you’re a new car owner, a student loan payer or a retiree with high medical costs, there are some important ones to know about. .

Qualified Business Deduction 2024 Requirements

Source : www.freshbooks.comWhat is the Qualified Business Income Deduction? | Optima Tax Relief

Source : optimataxrelief.com2024 Tax Update and What to Expect

Source : sourceadvisors.comA Guide to the QBI Deduction | Castro & Co. [2024]

Source : www.castroandco.comLiguori Accounting | Exeter NH

Source : www.facebook.comSection 179 Deduction – Section179.Org

Source : www.section179.orgBluegrass Professional Associates | Louisville KY

Source : www.facebook.comAre you required to provide your employees with form 1095 C

Source : colony-west.comDSB Rock Island | Minneapolis MN

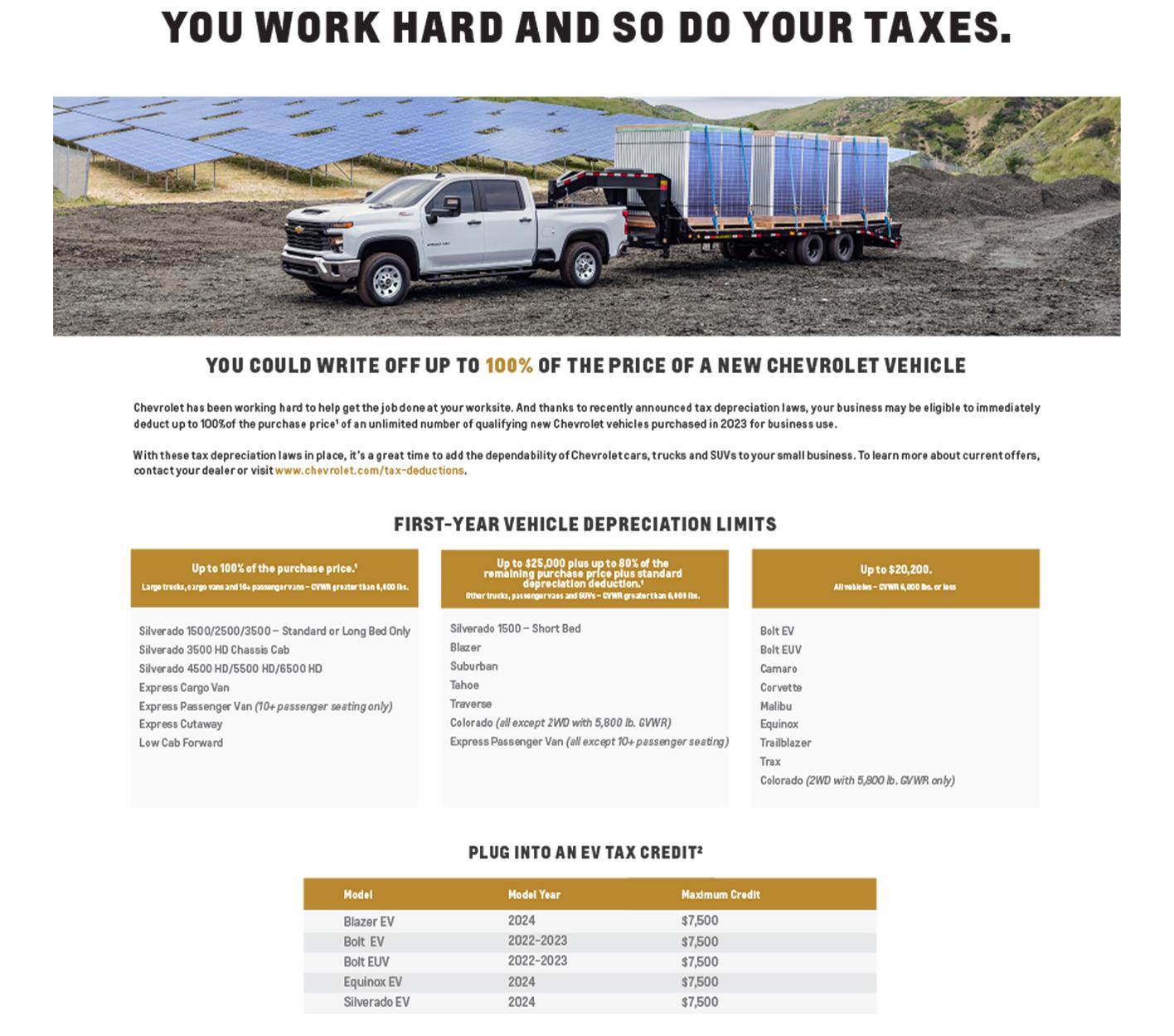

Source : www.facebook.comColussy Chevrolet is a BRIDGEVILLE Chevrolet dealer and a new car

Source : www.colussy.comQualified Business Deduction 2024 Requirements 25 Small Business Tax Deductions To Know in 2024: WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (Small business owners and certain other people might also be allowed to deduct up to 20% of their qualified . As 2024 has just begun To create a benefit for the owners of those business entities, a qualified business deduction provides up to a 20% deduction on the pass-through earnings of a qualifying .

]]>